The Evolution of Travelzoo

Emerging SAAS Company Trading at ~7x 2026 EPS

Travelzoo (“TZOO” or the “Company”) is a global travel deal aggregator. Reaching 30M subscribers , TZOO works with thousands of travel suppliers to provide its vast customer base with discounted travel offers. TZOO’s primary products are Travelzoo and Jack’s Flight Club.

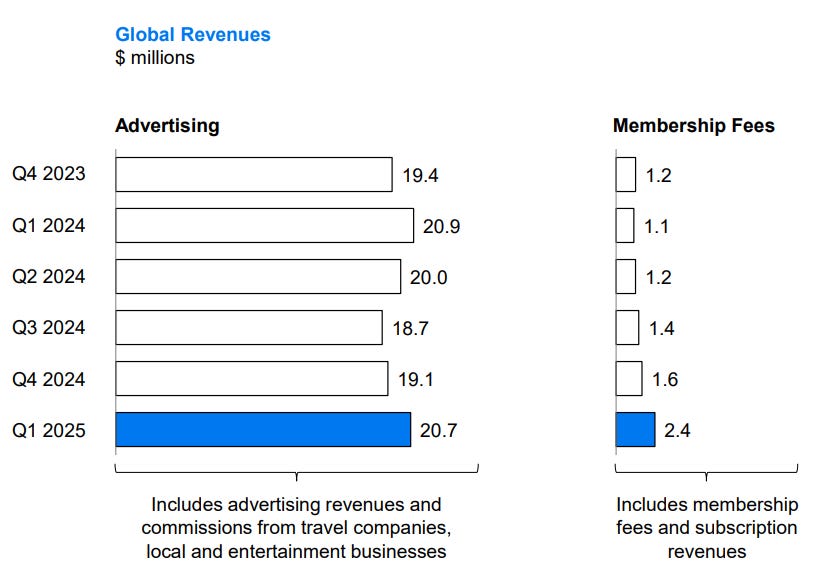

Historically, TZOO operated as free to subscribers with revenue primarily generated from advertising (advertising fees/commission/publishing fees) paid by travel suppliers/partners. In 2020, TZOO acquired a 60% stake in Jack’s Flight Club, introducing it to the subscription business (Jack’s generates revenue solely from subscriptions as opposed to advertising like Travelzoo). More importantly though, in 12/2023 Travelzoo announced a paid subscription membership tier at $40/year. For existing subscribers, that fee was waived for 2024. As such, paid subscription revenue would not materially ramp until 2025 and into 2026.

So what value does Travelzoo provide and why would someone pay for a subscription?

Travelzoo provides travel suppliers with an efficient way to lock in a large volume of business at a predetermined rate with Travelzoo effectively handling customer acquisition.

Example: If you are a tour operator, you are likely willing to reduce the rate if you can sell 100% of the tour and not have to deal with individual customer acquisition. Travelzoo will bundle this with other negotiated flight/hotel deals as well and sell it as a package.

Given that these deals are negotiated in volume, Travelzoo is able to pass on the savings to subscribers. Generally the deal savings are well in excess of the $40 fee, making it a no-brainer for people who already use Travelzoo.

I’d recommend looking at the website to get a sense for the types of deals offered.

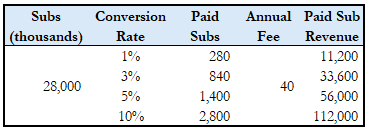

Without giving any credit to paid subscriptions from new subscribers, I estimate Travelzoo can realistically convert 1-5% of its existing 28M free subscribers (excludes Jack’s subs) to paid, reflecting potential subscription revenue of $11-56M. To put this in context, TZOO generated revenue and operating income of $84M and $18.5M, respectively, in 2024.

Paid subscriptions will provide TZOO with a consistent high-margin revenue stream, complimenting the more cyclical advertising revenue. It also provides travel suppliers with a new segment of more commited subscribers to advertise to. Advertisers continue to have access to Travelzoo’s full subscription base (paid and unpaid), with unpaid subscribers continuing to receive most travel communications. Conversion to paid subscription is required to purchase most deals.

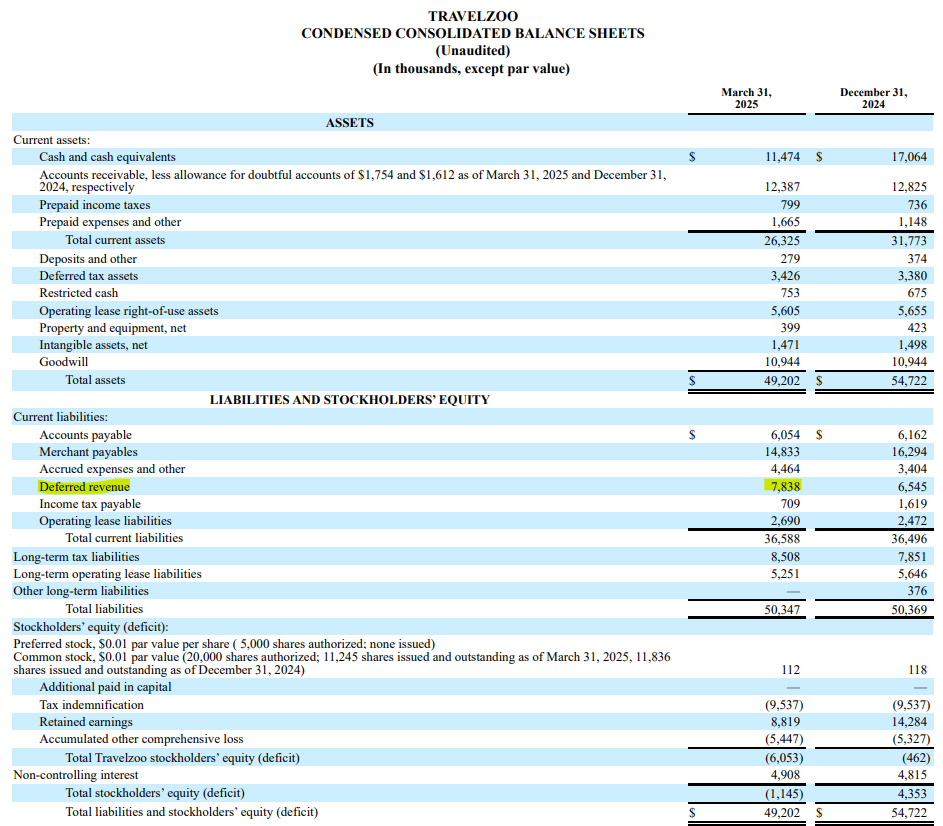

TZOO already has an attractive structure. It is asset-light (negative working capital / negative equity), conservatively financed (no debt / excess cash), capex-light (marginal capex spend), high margin (~20% operating margins), and has one method of returning capital to shareholders…share buybacks.

I believe the introduction of paid subscriptions for Travelzoo will fundamentally transform the company and ultimately accelerate earnings growth. Today, you can acquire shares at ~7x 2026E earnings providing for a base-case upside of 118% upon re-rating. I think the opportunity exists for the following reasons.

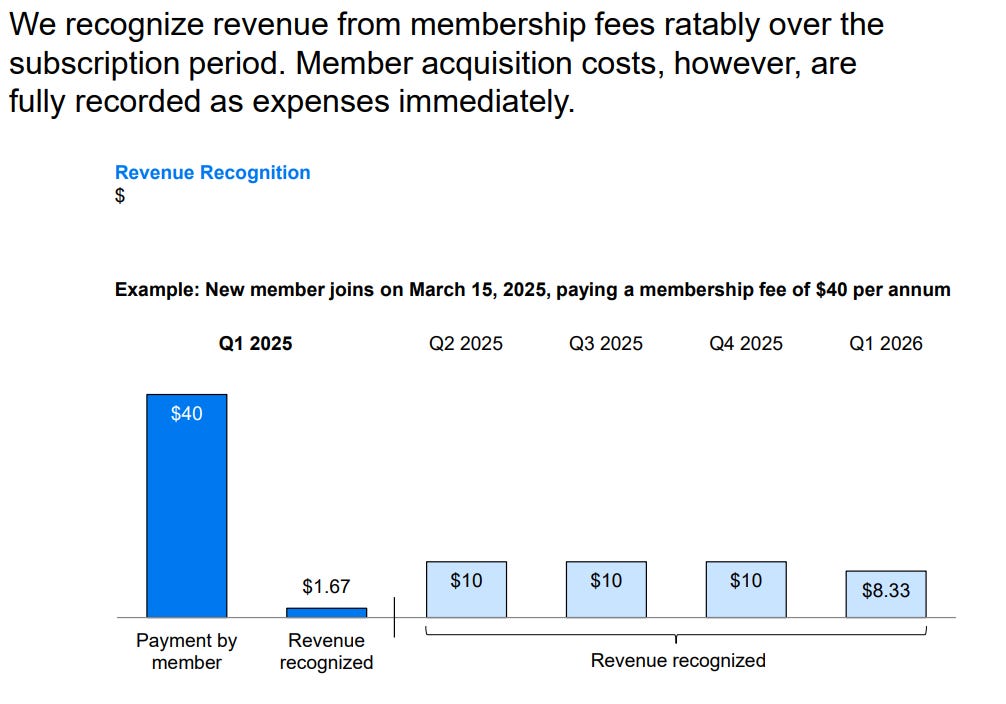

Misunderstood Economics

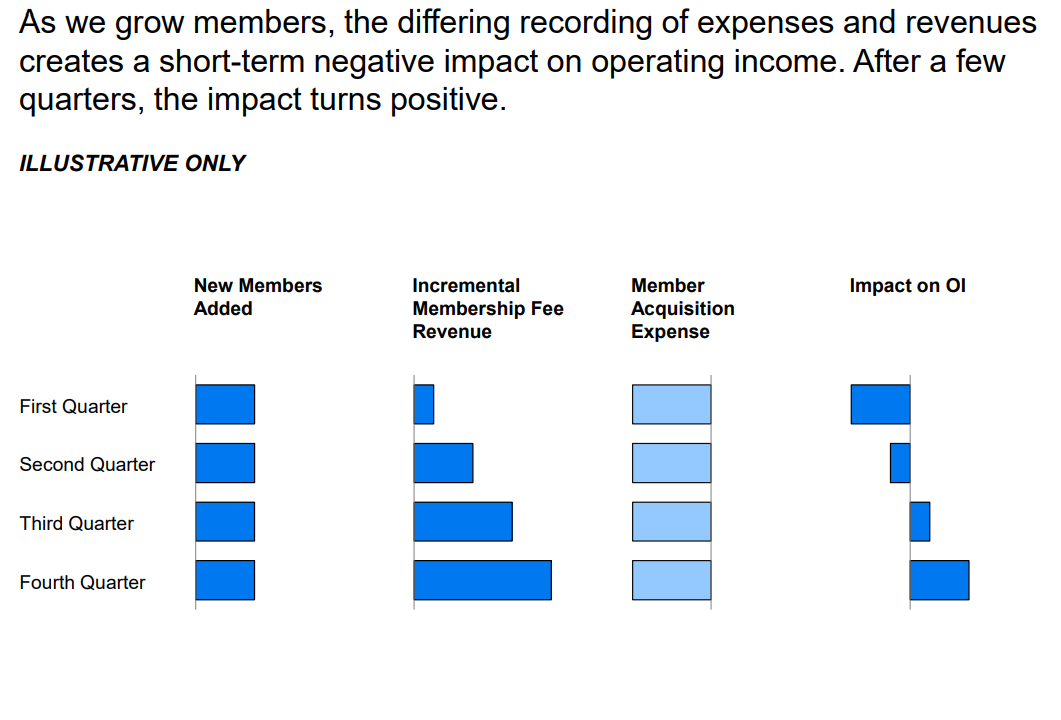

While the $40 subscription is a single cash payment, it is recognized over the course of the subscription period (1-year). Customer acquisition costs on the other hand are recognized immediately. As such, there is a mismatch on the income statement, leading to lower GAAP profits initially.

This should normalize in subsequent periods.

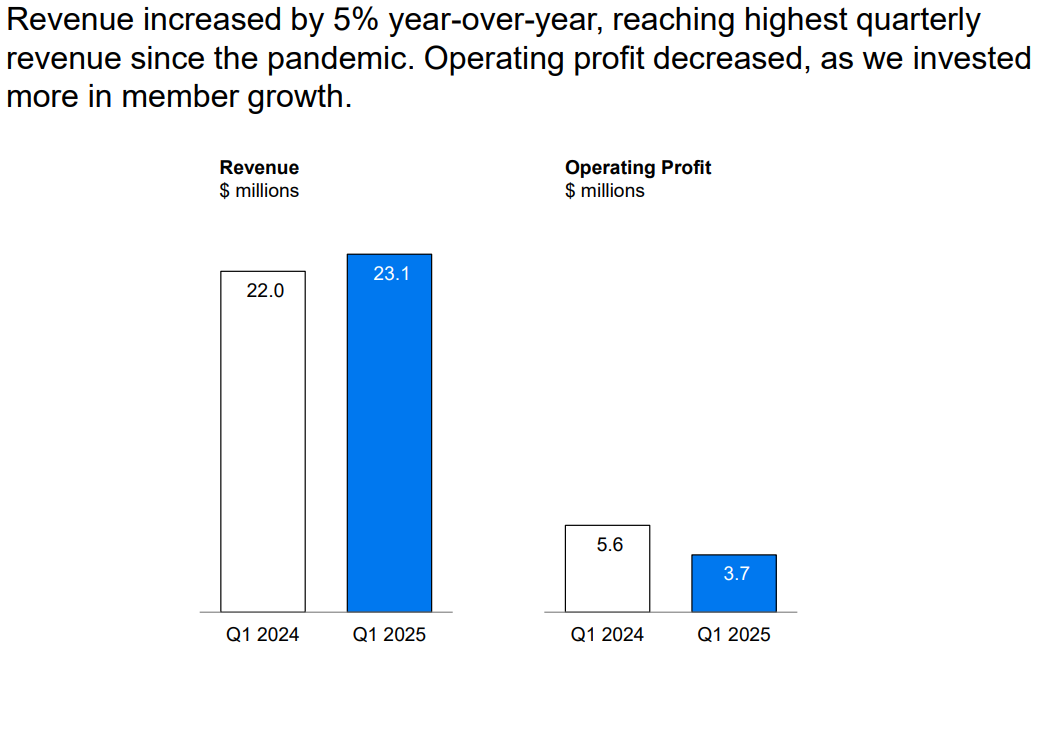

1Q2025 reflected this dynamic as customer acquisitions costs expensed immediately outweighed partially recognized subscription revenue, resulting in decreased operating profit.

The unearned portion of subscription revenue is captured within Deferred Revenue on the balance sheet.

Understanding what part of subscription revenue is deferred is a little tricky, as TZOO’s different properties have different subscription periods (Travelzoo is annual, while Jack’s Flight Club has quarterly, semi-annually, and annual options). In addition, other revenue items are also captured within deferred revenue. With that being said, this will be an important line item to watch in future quarters.

In 1Q2025, subscription revenue was up 118% YoY and 50% QoQ. Assuming the $800K QoQ increase in membership fees was driven by paid subscription for Travelzoo representing one quarter of accounting recognition, we can assume the annualized value is $3.2M. With an average subscription cost of $40/year, this represents 80K subscribers for the quarter. This will be an important part of our assumptions going forward.

Caution over Advertising-to-Subscription Transformation

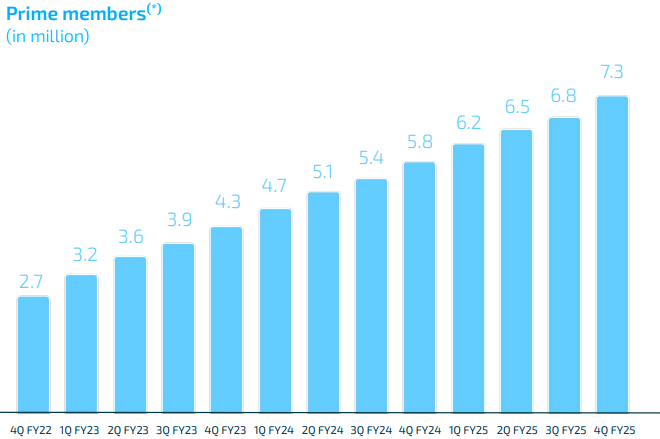

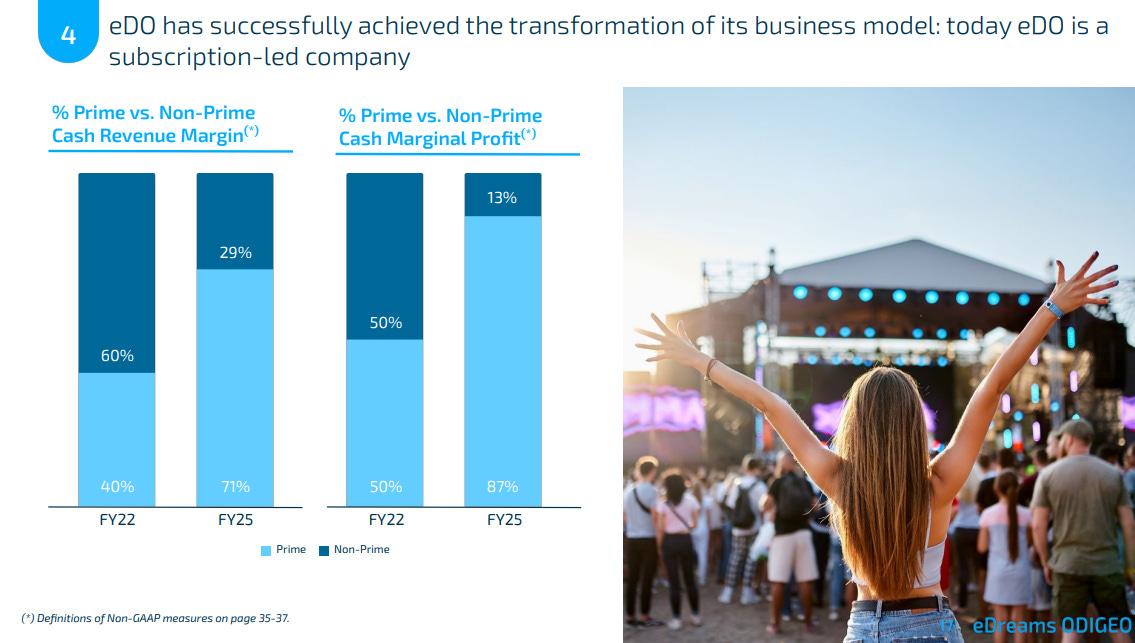

The advertising-to-subscription transformation by a travel company is not a novel concept.

In 2017 travel provider eDreams Odigeo SA launched a paid subscription called Prime. Today, Prime has 7.3M members and is the 7th largest subscription service in Europe.

eDreams fundamentally transformed from an advertising business into a subscription business with the majority of revenue and profit coming from Prime.

The key is if TZOO can efficiently convert existing free subscribers to paid subscribers at a reasonable cost. A few comments from the last two conference calls makes me think they can (i.e. they have a positive LTV/CAC ratio for paid memberships).

During the 4Q2024 Earnings Call CEO Holger Bartel said “We have finally built a robust model that allows us to acquire new members at a cost that works for us.”

In the 1Q2025 Earnings Call Holger said “…we're quite confident right now in our member acquisition activities, so we now have a better opportunity to invest in member growth than we had maybe a year ago, and that's where we would like to allocate the positive cash that the business is generating.”

Travel Industry Slowdown

Typically, any type of prolonged economic slowdown naturally impacts demand for travel and tourism. However, it does not appear that is the case currently.

The Wall Street Journal recently published an article on the state of the US economy, and it seems to be doing just fine.

Some anecdotal commentary from Delta and United’s 2Q2025 Earnings Call.

Delta Airlines: CEO Ed Bastian said “Turning to demand, the environment has been stable since resetting to a lower growth rate earlier this year. Overall demand for air travel remains similar to last year…”

United Airlines: CEO Scott Kirby said “As we look closely at the data, we've had a hypothesis that seems increasingly correct. Demand was weak for the last 5 months due to high levels of uncertainty for both businesses and consumers. I'm sure that's not a shocking thesis, but in the past few weeks, the level of uncertainty has declined. The tax situation is settled after the reconciliation bill passed. The geopolitical situation in the Middle East appears to have stabilized. And while tariffs are not yet certain, I think the market and most businesses have a much better read on how they'll manage in a narrower range of outcomes. And encouragingly, that higher level of certainty has translated into a meaningful inflection point in demand...”

Furthermore, while the major travel companies have not reported their 2Q2025 earnings yet, all are trading higher than pre-Liberation Day. Check out the stock charts below. So there appears to be investor confidence in the resilience of travel.

Morningstar publishes an interesting Travel Services Pulse Report. For 2Q2025, the US travel industry continued to perform well, with growth expected across the industry for the remainder of the year.

While it does not appear that there has been any substantial pullback in travel spending, in the event that there is I am not concerned. One of the key characteristics of TZOO’s business model is that it is somewhat countercyclical. Travel suppliers increase advertising/discounting as overall travel demand slows... which makes sense.

In response to a travel slowdown question during the 1Q2025 Earnings Call Holger Bartel said “But as we know from experience and as we saw in the last 30 days, the lower demand enables us to capture very strong offers from travel suppliers because ultimately they want to fill their hotels, they want to fill their airline seats, they want to fill their cruise cabins.”

Corporate Governance Concerns

There is definitely some concern around Corporate Governance here. Founder Ralph Bartel and his brother Holger Bartel (CEO) own a combined ~43% of common shares, providing them with total control over decision making.

Ralph Bartel has been gradually reducing his stake over the last several years, putting downward pressure on the stock. Ultimately, this is a good thing as he has been involved in some questionable decisions such as:

When he bought Travelzoo Asia (now defunct) for $3.6M in 2009, only to resell it back to TZOO for $22.6M 6-years later (article on it here).

Getting margin called during COVID-19 Pandemic and later effectively regranting himself the lost shares in 2022.

SEC charges over failure to disclose stake in Wilhelmina International, Inc. (here).

Ralph’s brother Holger has been CEO since 2016 and Head of Strategy since 2023. He has been with Travelzoo since 1999. Holger has a Ph.D. in Economics and an MBA in finance and accounting from the University of St. Gallen (a top european university). In addition, he has some experience in management consulting, having worked at McKinsey from 1995 to 1998.

Between his analytical education and his experience in consulting, I think Holger has an ideal background in the context of transforming Travelzoo. Then taking into account the Bartel’s ownership stake, I think they likely vetted the paid subscription concept thoroughly and are confident in its potential.

Given the substantial skin in the game (and lack of any capital return policy outside of share buybacks), I do think they are incentivized to maximize shareholder value. I view Ralph Bartel’s reducing stake as a positive, as he probably knows it is concern for investors. Holger Bartel seems to be a relatively capable operator, and has a background that I think is perfect for the type of transformation TZOO is seeking.

Valuation

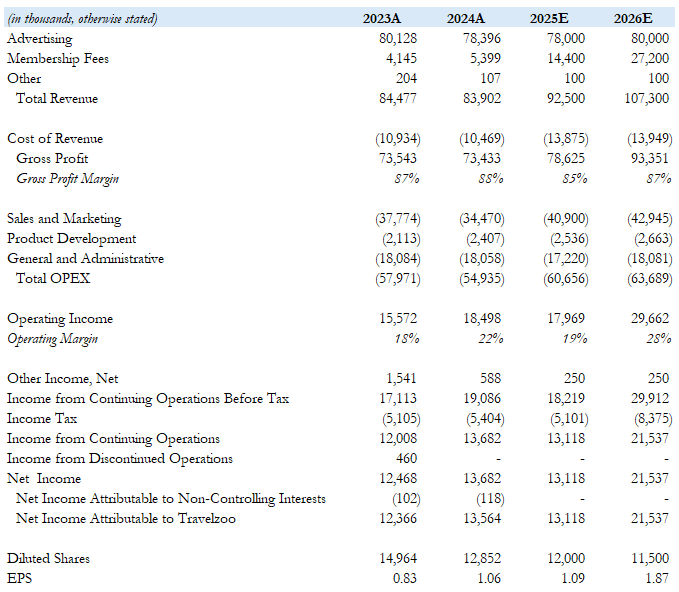

The math here is pretty simple. Extrapolating 1Q2025 financials, I think we get to $93M in revenue and $1.09 in EPS for 2025. For 2026, I think we get to $107M in revenue and $1.87 in EPS.

Advertising: Flat in 2025 and up slightly in 2026

Between some runoff from free subscribers unsubscribing as well as increased revenue from advertising to the more lucrative paid subscribers, I think this is likely flat-ish

Membership Fees: Extrapolating 1Q2025, growing at $800K/quarter (80K paid subs/quarter).

Other Revenue: $100K flat (Licensing / Travelzoo Meta)

Gross Profit Margin: 85% in 2025 increasing to a more normalized 87% in 2026

OPEX: 2025 is annualized 1Q2025, and 2026 is 2025 + 5%

Other Income: $250K (interest income on ~$10M cash)

Income Tax: 28%

Non-Controlling Interests: Assume Jack’s Flight Club is breakeven

Diluted Shares: Down to 12M in 2025 and 11.5M in 2026

I think we should see substantially more than this… as there is nowhere else to allocate free cash flow.

Using 2026E EPS of $1.87 and a valuation range of 12.5-17.5x, we get price targets of $23-33 per share reflecting an upside of 82-154%.

It is difficult to predict the timeline for when the market will wake up to TZOO and re-price the stock, but I believe is is likely late-2025 to early-2026 when paid GAAP EPS starts to pick up.

For the remainder of 2025, I am less focused on earnings and more focused on the following metrics:

Advertising more or less unchanged YOY

Membership Fees (Subscription Revenue) growing at $800K/quarter

GPM trending up towards ~85%

Deferred Revenue continuing to grow

Disclaimer

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer's securities.

This is not investment advice. Please do your own research.