For Part I on New England Realty Associates Limited Partnership (“NEN” or the “Company”), click here.

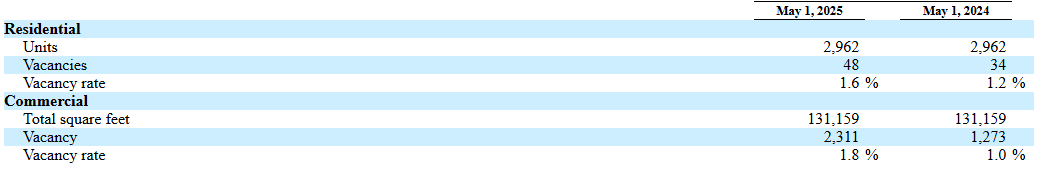

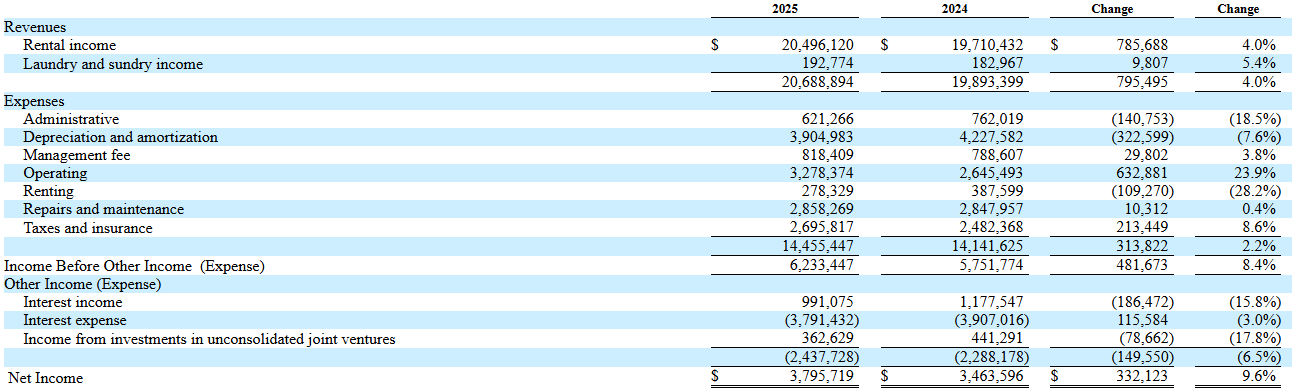

NEN’s 1Q2025 earnings reflect continued solid results. Vacancies remain low at 1.6% with rent growth of 4% YOY.

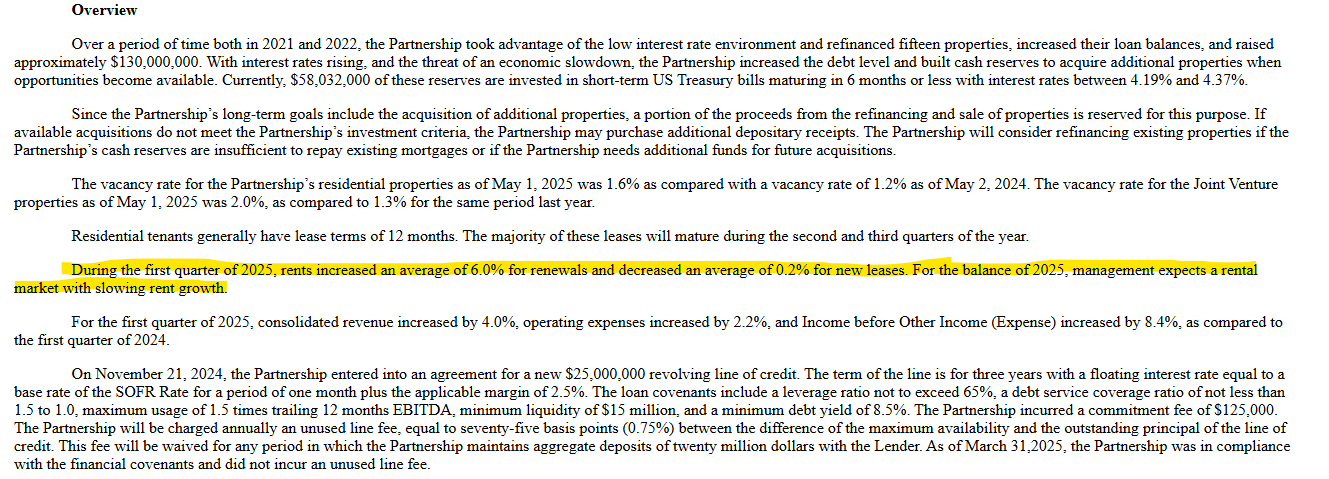

Rents for renewals were up 6% YOY while rent for new leases were flat. Management expects a rental market with slowing rent growth going forward.

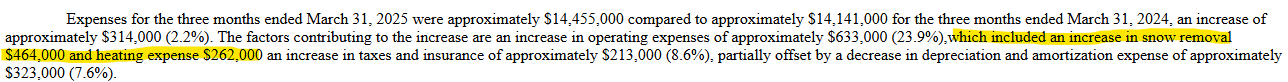

At first glance, NOI growth appears to be muted at 1.6% YOY on the back of increased operating expenses. However, some of these items were due to an unusually frigid winter during the quarter.

The 10Q stated that the majority of the expense increase was related to increases of $464K and $262K for snow removal and heating expense, respectively. These two items represent an increase of $726K. It should be highlighted Boston’s 2025 winter was one of the coldest on record in the last decade.

Assuming a more normalized winter and adding back half of the snow/heating expense increase ($363K) would result in NOI growing 5.2% YOY, a figure I am happy with.

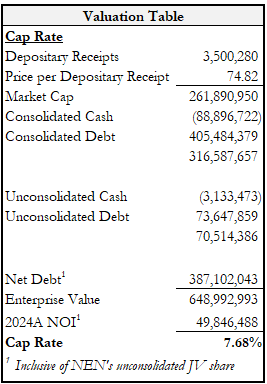

NEN continues to be attractively valued at a ~7.7% cap rate.

On 4/17/2025 NEN announced that they had entered into a purchase & sales agreement to acquire the ~400-unit multifamily complex Hill Estates in Belmont, MA for $175M ($440K/door). I tweeted some initial thoughts of the implications of the acquistion here. The local paper, The Belmontonian, provided some color on the complex here. This acquisition is transformative at 27% of the pre-deal EV and reflects management’s intent on continuing to grow the business opportunistically.

I have reached out to several local brokers to better understand the acquisition economics. Per the property’s offering memorandum which I have reviewed, Hill Estates is being acquired at a ~4% (~$7M NOI) cap rate based on in-place rents. Given that NEN is trading at a ~7.7% cap rate, the acquisition would not be accretive to shareholders at this price alone. However, upon digging into this deal some more, it appears that the property is significantly undermarket in terms of rents. The OM estimates rents are 27% under market as is. On a mark-to-market basis, pro-forma cap rate increases to 5% (~$9M NOI), relatively in-line with the market.

The real upside here is the value-add though. Hill Estates is extremely outdated in terms of unit finishes (29% unrenovated, 48% light renovations, and 23% renovated). There is a substantial opportunity to increase rents by renovating units to higher quality finishes.

In conversations with a buyer’s broker (who did not win the bid), they were underwriting to $11.5-12M in NOI by Year 4 based on all of this, a ~7% pro-forma cap rate.

I think that this NOI is achievable assuming renewing leases to market, a multi-year renovation plan to further drive rents, and low single digits market rent growth.

So what does this mean for NEN’s valuation?

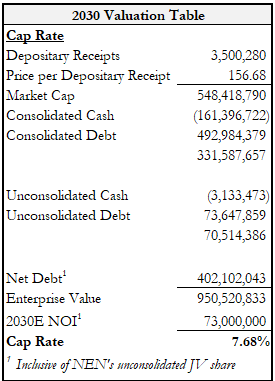

With some conservative assumptions by the end of 2030 (5.5-years), NEN could be generating NOI of ~$73M. This is based on:

Existing portfolio growing NOI 3%/year to $60M (from ~$50M in 2024).

New 72-unit Mills Street development generating NOI of $1.7M.

Hill Estates growing NOI to $11.5M.

If you cap $73M at the in-place cap rate of 7.68%, you get an enterprise value of $951M.

Trying to calculate net debt 5.5-years out is a little tricky, but using some fairly basic math, I calculate it as $402M. Assumptions include:

Using today’s $387M in net debt as a base

Add $175M acquisition of Estate Hills

Net $160M in free cash flow generated before dividends and amortization

This figure was $29M in 2024 alone, as such 5.5x figure equates to roughly ~$160M, and assumes zero growth

Zero additional acquisitions or developments

Taking this all together, we get a target price of $156.68 by 2030, implying a 14% IRR over the next 5.5 years.

This all assumes no multiple expansion (market cap rates are ~5%), minimal NOI growth, no additional acquisitions or developments, and no increase in free cash flow.

There is execution risk as it does assume NEN is successful in renovating and releasing Estate Hills to market rents.

Disclaimer

I do not hold a position with the issuer such as employment, directorship, or consultancy

I and/or others I advise hold a material investment in the issuer's securities.

This is not investment advice. Please do your own research.

No usually into Real estate companies but this was a great read

Thanks for this. Would love to get a post from you on NBN - I think you are a fan. Thank you.